SEATTLE — After unanimously passing a $275-per-employee tax on businesses last month, the Seattle City Council reversed their legislation with a 7-2 vote on Tuesday. The councilmembers who supported the motion to repeal the tax—Councilmembers Bruce Harrell, Lorena Gonzalez, Sally Bagshaw, Rob Johnson, Mike O’Brien, Lisa Herbold, and Debora Juarez—said that they were eager to arrive at another solution that brought businesses, governmental entities and organizations that supported the homeless to the table. Speakers who opposed the repeal, on the other hand, accused the politicians of capitulating to big businesses. The only commonality between the opposing viewpoints was the conclusion that the city currently doesn’t have the resources to address the housing crisis. Tuesday’s vote now casts uncertainty on the whereabouts of additional funding sources as politicians retreat to the drawing board.

The special meeting was called on Monday, when Council President Bruce Harrell announced that he would sponsor legislation to repeal the contentious tax estimated to generate $47 million annually. The tax that was poised to take effect in January 2019 would have funded homelessness services, emergency shelters, and affordable housing. Tuesday’s repeal followed the successful efforts of the No Tax on Jobs, a group backed by Amazon, Starbucks, Vulcan, and other big businesses which raised over $285,000 to back an effort to collect the 17,632 valid signatures needed to place a head tax referendum on the November ballot.

In a statement on Monday, Durkan and the seven councilmembers who supported the repeal conceded that the ordinance would cause a “prolonged, expensive political fight over the next five months that will do nothing to tackle our urgent housing and homelessness crisis.” Challenges such as lack of access to mental health care and affordable housing would need to be “addressed together as a city, and as importantly, as a state and a region,” they opined. The politicians stated that they were “committed to building solutions that bring businesses, labor, philanthropy, neighborhoods and communities to the table,” yet they have not proposed another measure to bring in additional funding.

The Seattle Metropolitan Chamber of Commerce, which opposed the head tax, agreed that greater collaboration among businesses and the government is needed to address the homelessness crisis. “The announcement from Mayor Durkan and the City Council is the breath of fresh air Seattle needs,” Seattle Metropolitan Chamber of Commerce President and CEO Marilyn Strickland said in a statement Monday. “Repealing the tax on jobs gives our region the chance to addresses homelessness in a productive, focused, and unified way.”

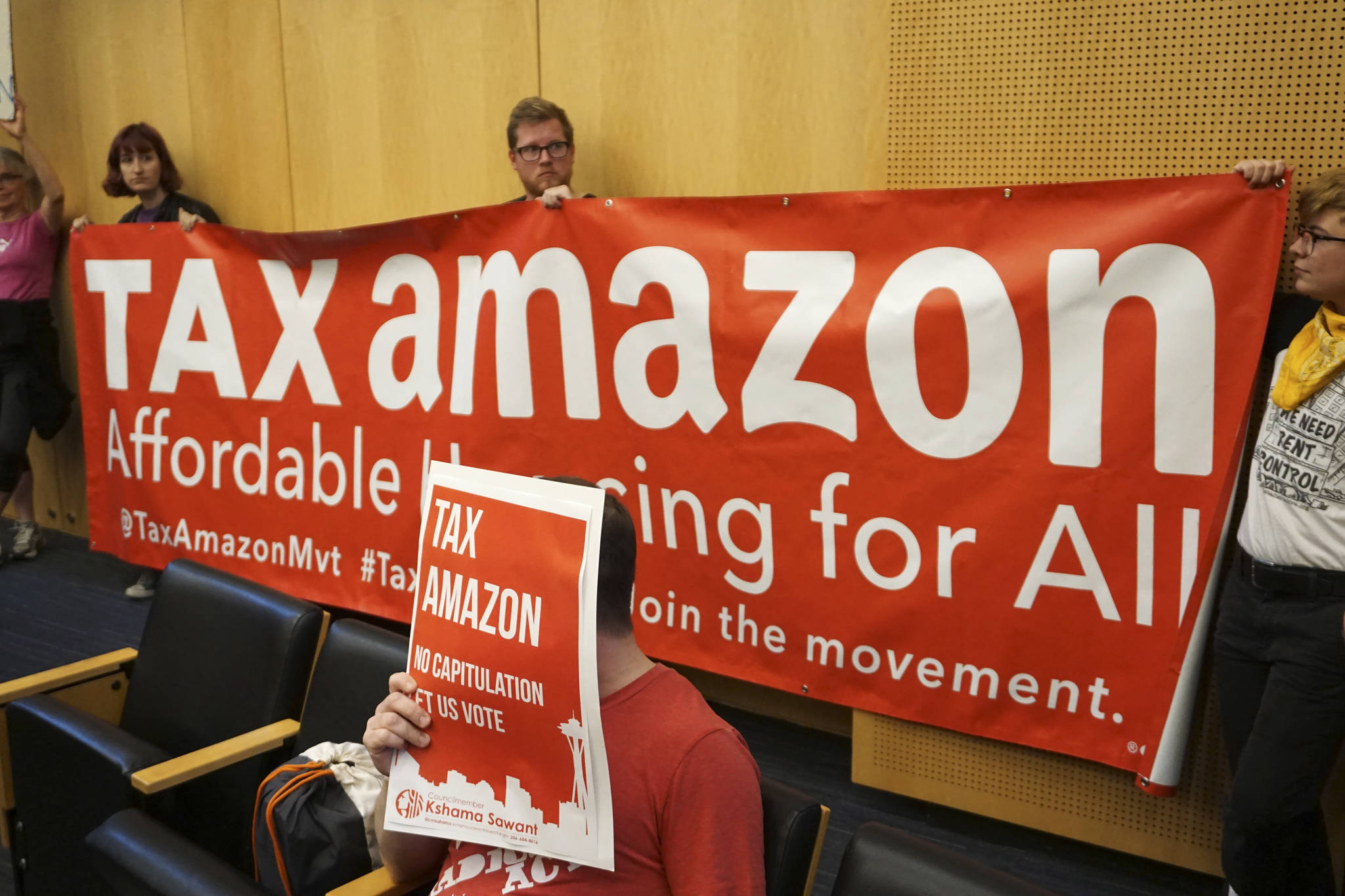

City Hall bustled with activity on Tuesday afternoon as people filed into the chambers to voice their opinions on the head tax repeal. Stationed in the lobby throughout the meeting, a Real Change member hit a gong 6,320 times to represent the number of people sleeping outside in King County. The county’s latest annual point-in-time count released in May revealed that 12,112 people are experiencing homelessness, a four percent increase from last year. Members of the public who opposed the repeal sang the refrain, “Everbody’s got a right to live,” as people filed up the stairs, filling every corner of the chamber. The room was divided by No Tax on Jobs supporters who held white signs seated on the left, and those on the right side who waved red signs in opposition that read: “Tax Amazon/Not Working People.”

“I’m going to be honest: I’m angry,” Emerson Johnson, a member of Kshama Sawant’s Socialist Alternative group, said at the start of the public comments. “What the city is doing is what they have always done, putting profit over people. That’s why we have a housing crisis and the most regressive tax structure in the nation.” The ordinance, which would have affected three percent of businesses, represented a change of pace for Seattle. An April Economic Opportunity Institute report showed that Seattle has the most regressive tax system in Washington, meaning that the poorest residents pay higher tax rates than the wealthy. A 2015 Institute on Taxation and Economic Policy report also indicated that Washington’s tax system was the most regressive in the country because of its heavy reliance on sales taxes.

A speaker who volunteered to collect signatures for the No Tax on Jobs campaign said that he was curious about where money for homeless dollars was being spent.

But not everyone who disagreed with the head tax believed that it should have been repealed. Tuesday’s vote now moots the need for a referendum, which drew the ire of political activist Tim Eyman, who told the city council that it stripped the voters of a chance to put in their two cents. “What about the voters? Why shouldn’t they be heard? Why are their voices being muzzled?” asked Eyman, who wore a blue shirt that bore the words: “Let the voters decide.”

Following an hour of public comments in which people vehemently spoke for or against the repeal, Councilmember Herbold shared her sentiments with the crowd. The employee head tax “is not a winnable battle at this time,” she said, blaming the Seattle Metropolitan Chamber of Commerce for convincing the majority of Seattle that the city spends its money inefficiently.

Councilmember O’Brien told the public that the head tax was the best solution to homelessness that the city had, yet he would be voting to repeal it because “I cannot see a path where we can move forward where six months from now, eight months from now we will actually have the revenue to do what we need. And I can’t tell you how hard it is to say that publicly.” The legislation that Durkan signed into law last month was nearly half of the original proposal of taxing $500 per employee, and was reached through compromise between the mayor and the councilmembers. However, the reduced head tax still paled in comparison to the $410 million needed to address the region’s homelessness crisis, a number suggested in a McKinsey & Company study for the Seattle Metropolitan Chamber of Commerce.

Although the majority of the councilmembers considered the repeal an opportunity to find common ground with different groups, Councilmember Kshama Sawant called it a “capitulation” to Amazon and other large businesses. Sawant admitted that there was a “tsunami of propaganda” from big businesses that had temporarily swayed public opinion, but that the head tax repeal would be a “cowardly betrayal of the needs of working people.” She invited her supporters to join her at Langston Hughes Performing Arts Institute on June 30 at 5 p.m. to discuss the next steps in finding a solution to the housing crisis.

Councilmember Teresa Mosqueda joined Sawant as the only other member who opposed the repeal.

“Let me be clear: Business has always been invited to the table. And when they boycotted, my door was always open,” Mosqueda said Tuesday. “But when I see construction jobs being threatened, I will work my ass off to make sure that there is a solution, and that is what we did. And within 48 hours of buying off on the proposal that this council unanimously approved, Amazon turned around and funded the opposition. And I don’t care if you’re with labor or if you’re with business, a hollow handshake and a broken promise is not good practice.” While she stated her willingess to come to the table, she also implored the public to consider their own role in finding ways to address the housing crisis. Mosqueda encouraged the public to say “yes to density,” and “yes to rezoning.”

In the eyes of organizations that represent low-income workers, big businesses should shoulder some of the costs to address the lack of affordability that they helped create.

“The behavior of the big business lobby groups throughout this whole process has been, frankly, shameful,” Katie Wilson, the Transit Riders Union general secretary, wrote in a statement emailed to Seattle Weekly on Monday. “They have offered no solutions. Instead they have poured their vast resources into a PR campaign to discredit the city council in the eyes of the public and spread misinformation about the progressive business tax and the homelessness crisis. They have cynically manipulated many Seattle residents’ legitimate concerns about rising property taxes and the impact of homelessness on their communities, to inflame prejudice and weasel out of making a modest contribution toward real solutions. They have made Seattle an uglier place.”

As the council voted, opponents of the motion to repeal gathered in front of the City Council. The public’s chant, “We are ready to fight, housing is a human right,” drowned out the voices of the council members as they voted, breeding confusion that was seen in disconcerted faces throughout the room. When the cacophany subsided, Sawant, who remained the last councilmember to vote, asked her supporters what they wanted her to say. “Stop the repeal,” they shouted in unison, but by that time it was too late.

_______

This story was first published in Seattle Weekly. Melissa Hellmann can be reached at mhellmann@seattleweekly.com.